Business Accounting & Tax Preparation

1585 W Wetmore Road, Tucson, AZ 85705

Mailing Address: P O Box 35743, Tucson, AZ 85740

Phone: 520-292-9773 Fax: 520-292-9878

Accounting By Design, Inc.

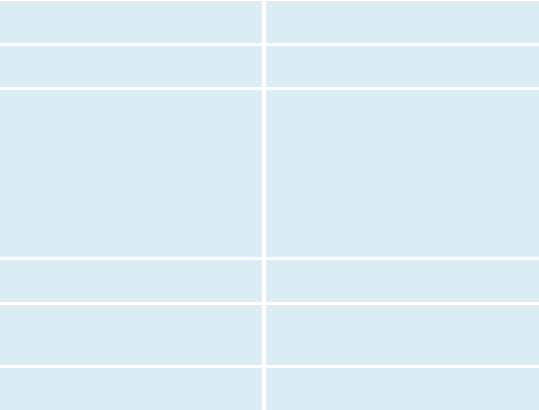

College Savings Plans

Qualified Tuition Program (QTP)

Coverdell Education Savings Accounts

(ESA)

Benefit

Tax-free Earnings

Tax Free Earnings

Annual Limit

None

$2,000 contribution per beneficiary

Qualifying Expenses

Tuition & required enrollments fees

Course related books, supplies &

equipment

Room & board for at least half-time

students

Expenses for special needs services

K-12 expenses

Tuition & required enrollments fees

Course related books, supplies & equipment

Expenses for special needs services

Payments to QTP

Higher education room & board if at lest

half-time student

K-12 room & board, uniforms, transportation

and computer access

Qualifying Education

Undergraduate & graduate

K-12

Undergraduate & graduate

K-12

Other Conditions

Maximum of $10,000 per year per student

for K-12

Certain rollovers to ABLE accounts

Assets must be distributed at age 30 unless

special needs beneficiary

Modified AGI Phaseout

None

$95,000 - $110,000

$190,000 - $220,000 MJF

•

Three (3) years from the date you filed your original return

•

Three (3) years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file

a claim for credit or refund after you file your return

•

Seven (7) years if you file a claim for a loss from worthless securities or bad debt reduction

•

Six (6) years if you do not report income that you should report, and it is more than 25% of the gross income on your return

•

Keep records indefinitely if you do not file a return

•

Keep records indefinitely if you file a fraudulent return

•

Keep employment tax records for at least 4 years after the date that the tax becomes due or paid, whichever is later

•

Ten (10) years if you paid taxes to a foreign government

•

Three (3) years after you sell property or investments

Click on Tax Records Retention to go to a more detailed list.

State of Arizona follows these same guidelines. Also remember there may be times that even though the records are no longer need for tax

purposes, do not discard them until you check to see if they should be kept longer for other purposes. Your insurance company or other

creditors mya required you to keep certain records longer than the IRS does.